A Reminder to Prepare to Receive Your 2020 W-2

As 2020 comes to a close, it is important to take a moment to review your personal payroll information, which is used to generate form W-2. It is important to be sure your information is up to date so a correct W-2 can be included with your personal taxes. Here are a few steps you can take over the next few weeks to update your information:

REVIEW YOUR CONTACT INFORMATION IN WORKDAY

Please review your latest pay statement in Workday to confirm that we have your current address on file. If you need to make any updates, please submit an address change in Workday by January 3, 2021 to ensure timely delivery of your 2020 W-2 form.

OPT TO RECEIVE YOUR W-2 ELECTRONICALLY (GO PAPERLESS)

By electing to go paperless, you will not be mailed a physical W-2 and will instead access your electronic W-2 in Workday when it becomes available. Whether or not you choose the paperless option, all associates will be able to access and print their W-2 in Workday. In January 2021, we’ll notify you once your electronic W-2 information for tax year 2020 becomes available in Workday.

To consent to receive your W-2 electronically, please follow these steps:

- Log in to Workday

- Go to the Applications section > Pay > My Tax Documents

- From the My Tax Documents page, select Edit

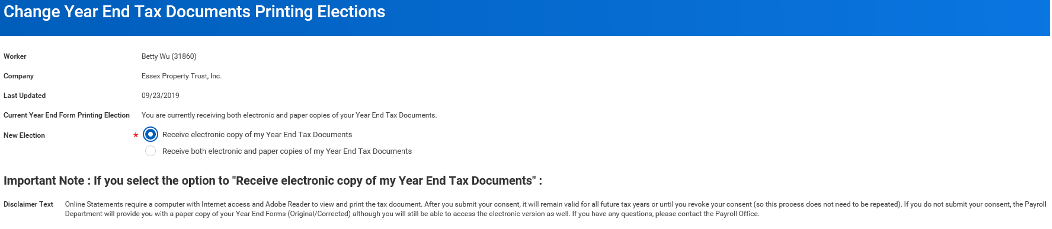

- From the Change Year End Tax Documents Printing Elections page, select the option to receive your Form W-2 electronically (screenshot below)

- Select OK > Done. You're all set!

QUESTIONS?

If you have any questions, please submit a ServiceNow ticket by logon to Okta > ServiceNow > Request Something > HR > Payroll

Monday, December 7, 2020 - 08:50