The 401K Plan has moved to Fidelity!

The Essex Retirement 401(k) plan allows both you and the company to start saving for your retirement! The 401(k) plan offers you a variety of investment choices to make saving for your retirement easier. You are automatically enrolled in the traditional 401(k) plan on the 1st of the month following 30 days of employment at 3% contribution. You can make a change to your contributions or opt out at any time of the year. Essex offers a traditional 401(k) and a Roth option.

The difference between our two options is when you will pay taxes on your contributions. With a traditional 401(k) your contributions are made pre-tax and you will pay taxes when you withdraw money. The Roth 401(k) option requires you to pay taxes on the money you invest now, but no taxes when you withdraw the money at retirement.

You can also access your 401k account via the mobile app NetBenefits to receive alerts and access resources/support to help reach your financial goals. Please click on the link below to access the Mobile App employee engagement toolkit. It has participant communications regarding the app (including Spanish) click here.

To learn more about the plan, read below:

Remember : The more you can save today, the better prepared you'll be tomorrow!

Fidelity - 401(k) Administrator

Fidelity is our administrator or "record keeper" for 401(k). Go to Fidelity’s NetBenefits at www.401k.com to view or make any changes to your 401(k).

First time user log in information: select “Register as a new user” on www.401k.com.

To register, use Name, Date of Birth, and last 4 digits of Social Security Number.

Already have a Fidelity account? Use the same credentials to log into the website.

For assistance call: 1-800-835-5095

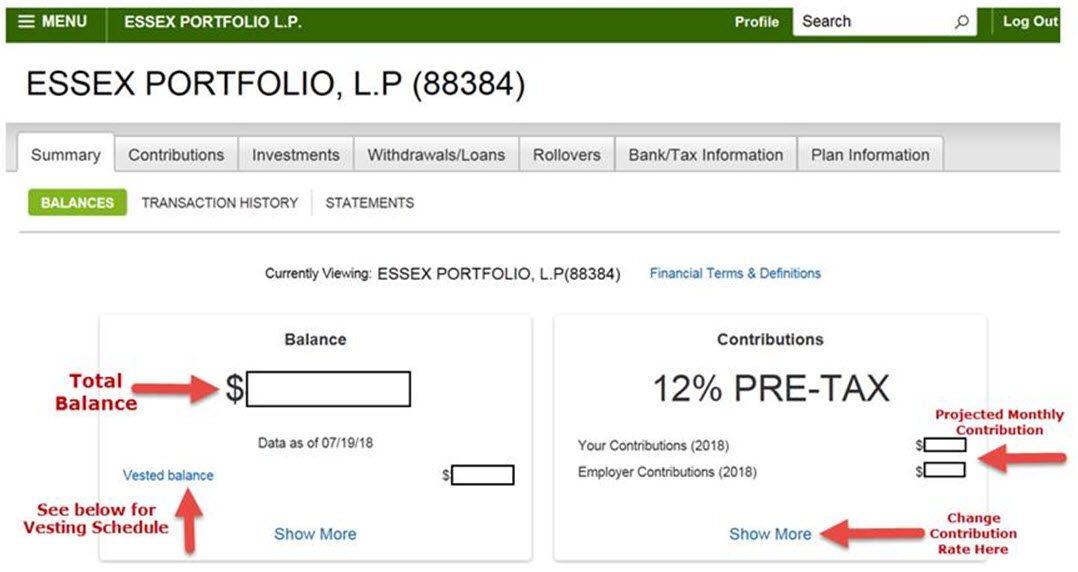

How To: View Balance and Make Contribution Changes

Company Match & Vesting Schedule

Company Match

The company matches $.50 on every $1 you defer up to a maximum of $6,000 in 2022!

Vesting Schedule

You are always vested for the money you contribute to the plan. However, to receive the company match, you must work the following amount of years.

| Years worked* | Vested percentage |

|---|---|

| 1 year | 25% |

| 2 years | 50% |

| 3 years | 75% |

| 4 years | 100% |

*Vesting starts on your date of hire, NOT when you enrolled in the 401(k) plan.

Contribution Limit

You can contribute from 1% to 75% of your compensation on a before-tax basis. The maximum amount you can contribute in 2022 is $20,500.

Catch-up Contributions

401(k) participants who reach age 50 and older will be permitted to make "catch-up" contributions - which means an additional pre-tax contribution of up to $6,500 for 2022 for a total of $27,000.

If you are turning age 50 in 2022, you will automatically be enrolled in the catch-up once you hit the $20,500 maximum. You no longer have to make a separate election.

If you have any questions, please submit a ticket by going to the ServiceNow portal and select Request Something, then click on HR and submit your inquiry to Total Rewards/Benefits.

NEXT Retirement Solutions Financial Services

If you have any questions on your finances and/or workplace retirement plan, the advisors at NRS, the same team that advises Essex on our retirement plan, can help answer your questions. For free assistance, call 1-888-529-4015, or email Info@NextRetirementSolutions.com.

Rollover

You may rollover distributions from your previous employer's qualified Section 401(k) plan to the Essex Property Trust Retirement (401k) plan.

What to do:

1. Contact Fidelity 800-835-509

A. Request a direct rollover distribution from your previous employer’s plan sponsor.

B. The rollover check is to be payable to:

Fidelity Investments Institutional Operations Company, Inc. (or FIIOC), for the benefit of (your name).

Log on to Fidelity NetBenefits at www.401k.com to initiate your request or complete the Incoming Rollover Contribution Application. Please be sure to complete all items and sign the form if indicated. Mail the Incoming Rollover Contribution Application and the check to:

First Class Mail with stamp:

Fidelity Investments Client Service Operations

P.O. Box 770003 Cincinnati, OH 45277-0065

Overnight Address:

Fidelity Investments

Client Service Operations (KC1F-L)

100 Crosby Parkway Covington, KY 41015

- Once your contribution is accepted into the Plan, you can log on to Fidelity NetBenefits at www.401k.com to view your rollover contribution and investment election(s). Please allow at least 7 business days for processing. If you have any questions about rollover contributions, call 1-800-835-5095. Please be sure you have beneficiary information for the Plan on file.

Loans

You may request a loan for a minimum of $2,000, and a maximum of %50 of your vested account balance to up $50,000. An employee may have only one loan oustanding at any time. Standard loans can be taken for up to 5 years and loans for the purchase of a primary residence may be made for 10 years (a sales agreement will be required to evidence the loan is for a primary residence). The full amount due under the loan may be prepaid at any time without penalty. Repayment of the loan will be made by payroll deduction in payments of principal and interest on each regularly scheduled payroll.

Permitted Loans:

- To purchase or refinance your primary residence.

- To prevent eviction or foreclosure on your primary residence.

- To pay for excessive medical costs.

- To pay for the post-secondary education for yourself or for immediate family members.

- To pay for burial services of parent, spouse/domestic partner, child, or dependent.

- To repair damage to the associate's primary residence that qualifies as a casual deduction under Code Section 165.

To request a loan, go to www.401k.com or call 1-800-835-5097. Upon requesting a loan application from Fidelity, associates will be required to provide hardship documentation to Human Resources to complete the loan documentation process. A hardship loan must be requested and approved before requesting a hardship withdrawal.

401(k) Retirement Beneficiary

Essex Property Trust, Inc. 401(k) Plan offers an online beneficiary feature. The online beneficiary feature enables you to update your beneficiary information on Fidelity's website. Your current beneficiary information is stored with your Human Resources department and this information will remain on file, but any future changes will need to be made online. This option is found under the 'Personal Info' tab, where you will select "Designate Beneficiary' to either add or update your information. You can change your beneficiaries at any time.

There are two types of beneficiaries - the primary and secondary beneficiary(ies). If a 401(k) participant passes away, the primary beneficiary(ies) receive the proceeds of the account. Usually secondary beneficiaries are also designated, in the event that a primary beneficiary may predecease the 401(k) participant. If you are married, your spouse is required to be your primary beneficiary, unless you indicate otherwise with the appropriate form. You can designate as many beneficiaries as you would like.

Termination

Upon retirement or termination of employment, participants generally may either keep their vested balance in the plan until they reach age 70 1/2 or choose another distribution method.

Lump Sum Distributions

Terminated participants may either receive their entire vested account balance in the form of a lump sum distribution, which generally may either be rolled over to another qualified plan or IRA, or paid directly to the participant.

Distributions made directly to participants are subject to a 20% mandatory tax withholding and may be subject to a 10% early withdrawal penalty if the participant is under age 59 1/2.

- Spousal consent is required for a married participant to obtain a lump sum distribution.

- Participants may receive a portion of their lump sum distribution as a direct payment and roll the remaining balance over to another qualified plan or IRA.

- If applicable, the company may direct distributions for terminated participants with a vested account balance less than $5,000. This distribution generally can be paid directly to the participant or rolled over into another qualified plan or IRA.

- Rollovers and Distributions made upon termination will be completed on www.401k.com.

Our Transition to Fidelity

The link below features a transition guide to help our E-Team with the upcoming transition over to Fidelity! Please review and reach out to the benefits team 650-655-7800 should you have further questions:

With more than 65 years of financial services experience, Fidelity has resources to help you put a plan in place that balances the needs of your life today with your retirement vision tomorrow.

Through Fidelity you will have access to tools and resources to help you makes decisions about your savings and spending.

If you have additional questions please call 1-800-835-5097 or submit a service request through the online ServiceNow portal, select request something and submit your questions to Total Rewards/Benefits.