Basic Life Insurance

Provides a benefit of 1x your annual salary up to $250,000 at no cost to you.

Supplemental Life Insurance

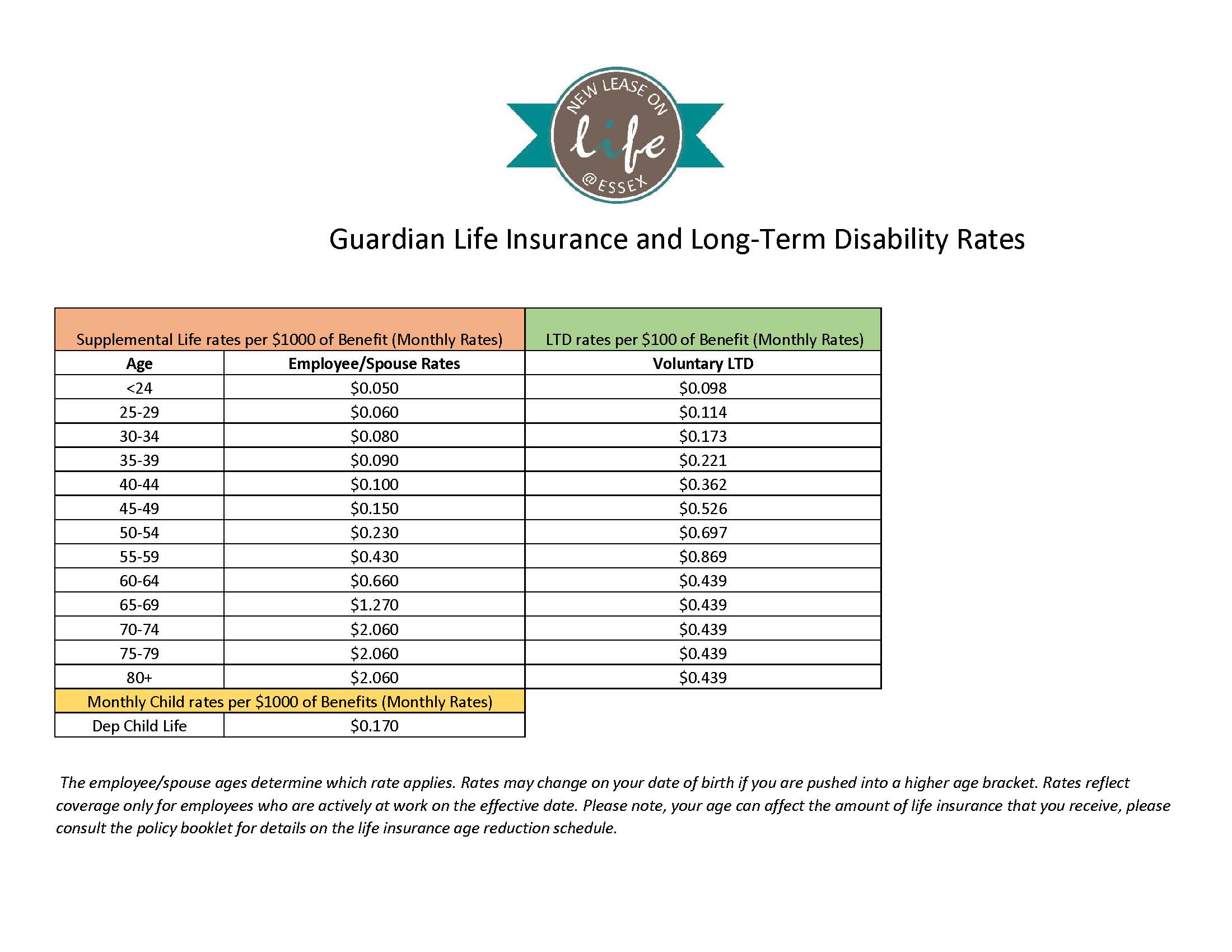

- Additional Life Insurance is available for you, your spouse/domestic partner and your children. The cost is based on the amount you elect and your age.

- Your age can affect the life insurance amount that you receive; please consult the policy booklet for details on the life insurance age reduction schedule.

- Additional Life and AD&D premiums are paid by the associate on a post-tax basis.

- Spousal insurance cannot exceed 50% of the employee's additional life insurance.

- Child life insurance may only be obtained if the employee is signed up for additional life insurance.

Disability Insurance

California Disability Insurance

- Short Term Disability: No longer an Essex provided plan; SDI provided through EDD. Receive 55% of monthly earnings from state.

-

Long Term Disability: Benefit Volume is 50% of monthly earnings up to a maximum of $10,000 per month.

- Coverage begins after 90 days of disability

- Benefits received are subject to federal income tax

- Pre-existing condition clause: 3 month look back, 12 months treatment free

- Supplemental Disability Insurance premiums will change based on your birth date and on the effective date of any salary changes.

- Benefit is 100% associate paid.

Washington Disability Insurance

- Short Term Disability: No longer an Essex provided plan; SDI provided through EDD. Receive 55% of monthly earnings from state

-

Long Term Disability: Benefit Volume is 50% of monthly earnings up to a maximum of $10,000 per month.

-

Coverage begins after 90 days of disability

-

Coverage begins after 90 days of disability

- Benefits received are subject to federal income tax

- Pre-existing condition clause: 3 month look back, 12 months treatment free

- Supplemental Disability Insurance premiums will change based on your birth date and on the effective date of any salary changes.

- Benefit is 100% associate paid.

Evidence of Insurability (EOI)

EOI is an application process in which you provide information on the condition of your health or your dependent's health in order to be considered for certain types of insurance coverage. All new hires who sign up for additional Life Insurance (Employee Life, Spousal Life, and Child Life), Short Term Disability (WA), and Long Term Disability are automatically approved. Outside of new hire, you must fill out an EOI Application to sign up for the benefit. Guardian will review your application and notify you of approval or denial. Only after the EOI is approved by Guardian will the benefit be active. If you have any questions, please submit a ticket by going to Service Now portal and select Request Something, then click on HR and submit your inquiry to Total Rewards/Benefits.

To complete the EOI application, click here or go to: https://www.guardiananytime.com/eoi/.

To complete the process, you may need to provide:

- Group ID/Plan Number (511190)

- Coverage(s) being requested

- Health History/Doctor Information

- Current insured amount

- Additional amount being requested

Customer Service Numbers for Guardian:

- To check the status of a Voluntary Life EOI application: 1-800-627-4200

- For general LTD questions: 1-800-538-4583