Essex recognized as top REIT performer

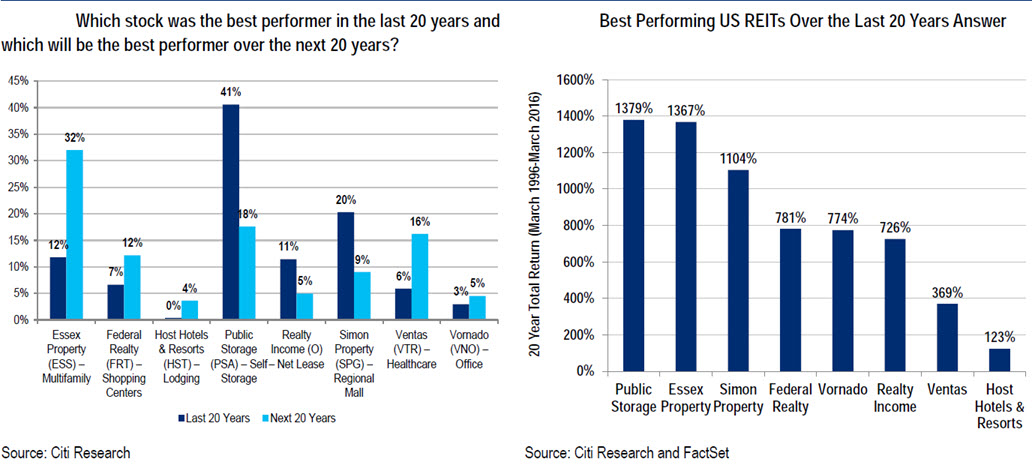

At Citi's 2016 Global Property CEO Conference, which took place earlier this month, Essex was recognized by institutional investors as most likely to be the best performing stock over the next 20 years. In addition, Essex was also a top performer among US REITs over the previous 20 years.

Additional highlights from the conference include comments from Mike Schall presented on behalf of Essex, noted below.

- Market outlook - Mike Schall commented that the greatest misperception is the view that the tech industry could experience a downturn similar to that of the 2000-2001 bust. The reality, according to ESS, is that the tech industry is very different today versus 2000. This is seen in price-to-sales ratios which were at ~49X in 2000 versus ~6.5X today.

- Operations – Overall, ESS is trending ahead of guidance in each of their markets. In January and February, SSRev was +6% in SoCal, +9.1% in NoCal, and +7.1% in Seattle. Total SSRev of +7.3% is above the midpoint of guidance at +7%. Additionally, February showed acceleration relative to January. In February, SoCal was +6.5%, NoCal was +9.5%, and Seattle was +7.9%. February SSRev was +7.8%. In general, ESS believes 4Q results were impacted by supply in NoCal. More specifically, ~10k units delivered in NoCal during 2015. Of these, ~4,400 delivered in 4Q alone. ESS expects some choppiness over the next couple months but a return to more normal seasonality in 2016.

- Transaction Market – Overall, the transaction markets are in good order with plenty of capital chasing the relatively few assets on the market. Available product is primarily from merchant builders and value-add properties. The value-add plays are going for aggressive cap rates which has pushed down cap rates in general. ESS recently took advantage of the competitive transaction market by opportunistically selling Sharon Greene in the high 3% cap rate range.

- Condo Conversions – ESS has not seen a large number of condo conversions. Current housing prices are not quite high enough to support condo conversions but the market is getting closer to that point.

- BRE Integration – The BRE portfolio integration is largely complete. On the expense side, BRE controllable expenses are now below ESS expenses, which was expected given BRE assets are newer. On the revenue side, ESS implemented the renovation program which will create some y/y vacancy. Resource management is still being executed so there could be further savings there. The focus now is largely on the consumer and employee experience.

- Geographic Expansion – ESS has no interest in being a bi-coastal apartment REIT. ESS expects to remain a West Coast focused apartment REIT as there is still significant opportunity for growth.

- Stock Repurchases – ESS recently approved a $250m buyback program and is willing to execute under that program provided there is sufficient weakness in the stock price.

- M&A – ESS does not expect further public multifamily consolidation in the near term.

For the full report from the conference, download this document:

Thursday, March 24, 2016 - 10:30

Last updated:

March 30, 2016