1095-C FAQ’s

New healthcare reporting law

Since 2014, the healthcare reform law (the Affordable Care Act (ACA) or “Obamacare”) has required individuals to have health insurance that meets the “minimum essential coverage” standards or potentially pay a penalty. When you file your Federal income tax return, you must indicate whether you (and your dependents) had the type of health insurance required by the law. The IRS will also receive information about your coverage from your employer and/or your health insurance provider.

What do I put on my tax return?

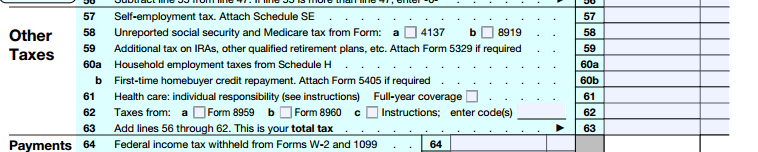

You will indicate whether you (and your dependents) had coverage on your Federal income tax return by checking a box on the form you are filing. On IRS Form 1040, this information is requested on Line 61.

You will receive information from your employer and/or your health insurance provider about the coverage in which you are enrolled and/or were offered, but you should not provide this information to the IRS with your tax return. This process functions in the same manner as your Form W2 in that regard.

What information about my coverage will I receive?

If you enrolled in coverage, you will receive a Form 1095-B from our insurance carrier, [Kaiser, United Healthcare or Group Health]. This form notes which members of your family were covered and in which months. Information from Form 1095-B can be used in completing your Federal income tax return.

In addition, as part of this law, Essex will send you a Form 1095-C which shows which months of the year you were eligible for coverage and the cost of the least expensive monthly premium you could have paid under our plans for employee only coverage. You will receive a 1095-C even if you declined coverage.

Keep all forms you receive with your tax documents in case you are ever asked to provide proof of coverage. Your tax preparer may also ask for these forms as documentation. You do not need to submit these forms with your taxes and can prepare taxes without them if you know the months of the year that you (and your dependents) had coverage.

How will I know if I owe a tax penalty?

If you and your tax dependents had healthcare coverage for all of 2016, you will not owe a tax penalty. However, if there was a gap in healthcare coverage of more than three months, you may have to pay a penalty when you file your Federal income taxes. If you had a gap in coverage, talk to your tax advisor about whether you may qualify for an exemption due to financial hardship or other accepted reasons.

What if I or my dependents had other coverage?

If you are covered under your spouse or domestic partner’s plan, these forms will be provided by his or her employer and/or insurance carrier. If you were covered by a healthcare marketplace plan, you would receive a similar form (1095-A) from your healthcare carrier.

When will I receive the forms?

For your 2016 tax filing, you should receive your forms by March 2, 2017. This deadline was recently extended from January 31, 1, 2017. You should timely file your individual tax return even if you do not receive a 1095 before the April 15 tax filing deadline.

Won’t all this go away soon?

It is unclear whether and when the individual and/or employer mandates will no longer be effective. While the fate of the ACA is uncertain at this point, your tax filing covers the 2016 calendar year, during which the individual mandate was in effect, so you are required to include your coverage in that filing. Moreover, employers remain subject to the requirement to provide these Forms to employees and IRS. The ACA, including the individual mandate to have minimum essential coverage and the employer reporting requirements to provide employees and IRS with Forms 1094 and 1095, remain applicable until such time that a repeal is effective.

Who can I contact with questions?

If you have questions, contact Kristen Kurland at kkurland@essex.com or by calling 650-655-7949.